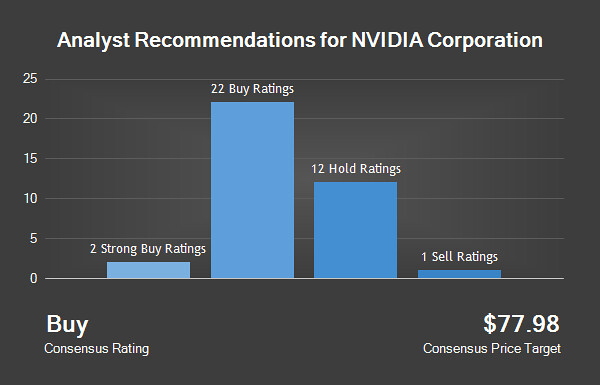

NVIDIA Corporation (NASDAQ: NVDA) had its target price of analysts S & P Equity Research $90.00 $24.75 bags in a report released Thursday. About S & P Equity Research destinations price to potential lower 76.81% of the former population.

Several other equity analysts have also issued reports on stocks. ARGUS raised its target price on the shares of NVIDIA Corporation of $95,00 $130,00 and gave the company a rating of "buy" in a report on Wednesday, December 28. Mizuho reissued a 'buy' rating and set a target price of $115,00 (up to before $80.00) in shares of NVIDIA Corporation in a report of research on Tuesday, December 20. Goldman Sachs Group, Inc. (the) proposed actions of NVIDIA Corporation of a rating from "buy" to a "conviction buy" rating and raised its target price for the company of $92.00 $129.00 in a research report Tuesday, December 20. Degraded Vetr shares of NVIDIA Corporation of a rating from "buy" to a "hold" rating and a target price of $103,39 for the company. in a research report Monday, December 19. Finally, ISI Evercore shares of NVIDIA Corporation of a "hold" rating to a rating of "buy" had been raised and had raised his price target for the company of $91,17 to $120.00 in a research report Wednesday, December 14. An equities research analyst has described the action with a sale rate, twelve have assigned a hold rating, twenty-two has assigned a buy rating and four have been given a rating strong buy the company. NVIDIA Corporation currently has a degree of consensus "Buy" and a target of average price of $79.29.

NVIDIA Corporation (NASDAQ: NVDA) opened at 106.74 Thursday. The action has a cap of $57,53 trillion market, 54.54 P/E ratio and a beta of 1.29. The company has a 50-day average price of $96,52 and a 200-day price average of $68,98. NVIDIA Corporation has a minimum of 1 year of $24.75 and a 1-year $119,93.

NVIDIA Corporation (NASDAQ: NVDA) last published its earnings results on Thursday, November 10. Computer hardware manufacturer reported earnings of $0.94 per share (EPS) for the quarter, exceeding the estimate of consensus from Thomson Reuters of $0.57 per $0.37. NVIDIA Corporation had a net margin of the 19.52% and a return on equity of the 26.82%. The firm earned $2 billion during the quarter, compared with the estimates of analysts of $1.69 billion. During the same period last year, the company earned profits of $0.44 per share. The company's income was 53.6% on a basis year after year. Stock analysts expect that NVIDIA Corporation will publish earnings of $2.42 per share for the current fiscal year.

The company also recently announced a quarterly dividend, which was paid on Monday, December 19. Investors of record on Monday, November 28 received a dividend of $0.14 per share. This is a reinforcement of the previous payment of quarterly dividend of $0.12 NVIDIA Corporation. The former date dividend was Wednesday, November 23. This represents a dividend of $0.56 on an annualized basis and 0.52% performance. NVIDIA Corporation dividend payment ratio is currently 29.32%.

In related news, EVP Debora Shoquist had sold the 19.265 shares in a transaction that occurred on Thursday, December 29. The shares were sold at an average price of $104,88, for a total transaction of $2,020,513.20. After the completion of the sale, the Executive Vice President now owns 318.791 shares of the company, valued at $33,434,800.08. The transaction was reported in a presentation before the Commission of stock exchange and values, which is available at this link. Also, Director tench Coxe sold 50,000 shares of the stock in a transaction that occurred on Tuesday, December 27. The shares were sold at an average price of $116,70, for a total transaction of $5,835,000.00. The disclosure of this sale can be found here. The initiated corporate own 5.82% of shares of the company.

A number of large investors recently has bought and sold shares in the stock market. Livforsakringsbolaget Skandia Omsesidigt drove his participation in NVIDIA Corporation from 28.7% in the second quarter. Livforsakringsbolaget Skandia Omsesidigt now owns 71.777 shares of computer hardware manufacturer is worth $3.374.000 after buying a 16,000 additional shares during the last quarter. RegentAtlantic Capital LLC acquired a new participation at NVIDIA Corporation during the second quarter is worth approximately $262,000. Eagle Asset Management Inc. acquired a new participation at NVIDIA Corporation during the second quarter is worth approximately $23,997,000. Nordea AB investment management increased its participation by NVIDIA Corporation 114.1% in the second quarter. Nordea AB investment management now owns 33.823 shares in the manufacturer of computer hardware is worth $1.590.000 after buying a 18,023 additional shares during the last quarter. Finally, Acadian Asset Management LLC boosted its stake in NVIDIA Corporation 130.9% in the second quarter. Acadian Asset Management LLC now owns 17.360 computer hardware manufacturer shares worth $816.000 after buying a 9.842 additional shares during the last quarter. 84.11% stake is owned by institutional investors.

NVIDIA Corporation company

Corporation of NVIDIA (NVIDIA) is dedicated to visual computing. The company operates through the segments, including Tegra processor and GPU. Your GPU include GeForce for personal computer (PC) games; Quadro to design professionals in design assisted by computer, video editing, special effects and other creative applications; Tesla of deep learning and accelerated computing, taking advantage of the capabilities of graphics (GPU) units for general-purpose computing and processing NETWORK to provide the power of graphics NVIDIA through the cloud and parallel computing data centers.

.jpg)

No comments:

Post a Comment